Over the past years, cryptocurrency has taken the financial world by storm with its fast growth, decentralization of its nature, and promises of huge profits. With this whirlwind romance comes equal skepticism. Above all, is cryptocurrency safe? And if you decide to invest, how will you profit from this volatile market? This article will break down both the safety concerns surrounding cryptocurrencies and actionable tips on how to generate profit in this dynamic industry.

Understanding Cryptocurrency and Its Appeal

Cryptocurrency is a type of digital or virtual currency in which cryptography secures its transactions. Whereas conventional fiat currencies are centrally controlled, most cryptocurrencies are decentralized and therefore operate on technology called blockchain. While Bitcoin was the first in 2009, thousands exist today, including Ethereum, Litecoin, and Ripple.

It is this very promise of cryptocurrency-that of decentralization and freedom from traditional systems of banking, and of high returns-which makes it unsafe.

Is Cryptocurrency Safe?

When it comes to safety, cryptocurrency has both strengths and risks. Let’s examine both sides.

1. Blockchain Technology – A Pillar of Security

As such, most investors view cryptocurrency as safe because of blockchain. Blockchain is a decentralized ledger that stores all transactions made in the computers of the network. All transactions are put into blocks, and after the addition into the blockchain, it is permanent and tamper-proof. In addition, this distributed nature, and this transparency is a great contribution to blockchain being highly secure.

Key Blockchain Security Features:

Decentralized: No one controls the blockchain, and this greatly reduces fraudulent transactions or manipulations.

Transparency: The transactions are recorded on a public ledger, allowing little room for covering up manipulative moves.

Encryption: Transactions on it are cryptographically secured; hence, highly secure.

2. Risks Associated with Cryptocurrency

Despite blockchain security, cryptocurrency also entails major risks for investors. You should understand the following before making any investment decisions.

a. Volatility

One of the highest concerns is the extreme volatility of cryptocurrencies. These can wildly fluctuate in price within hours. Bitcoin, for example, saw swings of a few thousand dollars per day. This volatility of cryptocurrencies will be a risk that attracts less investment, since there is a possibility of major losses within a very small period.

b. Hacking and Cyber Attacks

Even though blockchain technology is secure, the platforms that facilitate cryptocurrency trading and storage are not immune to cyberattacks. Exchanges have been hacked, leading to the loss of millions in assets. For example, the infamous Mt. Gox exchange hack resulted in the loss of around $450 million worth of Bitcoin in 2014. This highlights the need for safe practices in storing and trading cryptocurrencies.

c. Lack of Regulation

One major weakness of cryptocurrencies is their decentralized nature, which could equally be one of their major strengths. Without some kind of central regulation, transactions occur without oversight by either governments or financial institutions. This brings freedom from the traditional banking systems into the picture. It means that, should something happen, as an investor, you don’t stand much protection. b) When your cryptocurrency is lost or stolen, there may well be no way to recover it.

d. Scams and Fraud

A lack of anonymity and regulations in this cryptocurrency market would have attracted fraudster hosts to this money train. Most scams relate to faking initial coin offers, phishing schemes, and even Ponzi schemes. These are just but a few of the major risks in the crypto world. For sure, new investors have to be wary of offers that seem too good to be true.

How to Protect Your Cryptocurrency Investments

Despite these risks, there are steps you can take to safeguard your cryptocurrency investments:

1. Use Reputable Exchanges

Invest in and sell your cryptocurrencies through reputable exchanges. The most reputable exchanges, such as Coinbase, Binance, and Kraken, have implemented various security features to protect the users of their platforms. Look out for 2FA, encryption, and secure storage options such as cold wallets or offline storage that help protect your investments from thieves.

2. Secure Your Wallet

The other thing to know about cryptocurrency is that it is kept in a wallet where one can store both private and public keys in order to access their crypto. Generally speaking, there are two kinds of wallets:

Hot Wallets: These are the ones connected to the Internet; thus, they are easy to access yet highly exposed to being hacked.

Use Strong Passwords and Two-Factor Authentication

Never give out vital information like your private keys or seed phrase to anybody.

Cold Wallets: These are the offline storage options that are best for long-term storage of major quantities.

4. Be Cautious about Phishing and Scams

Always double-check the URLs, email addresses, and messages from the exchanges or wallet providers; never send cryptocurrency to individuals who contact you out of the blue, promising things that sound too good to be true.

5. Diversify Your Portfolio

Just like traditional investments, it’s wise to diversify your cryptocurrency portfolio. Don’t put all your funds into one coin. Spread your investments across several different coins and tokens to minimize risk.

How to Profit from Cryptocurrency

While safety is crucial, many people are attracted to cryptocurrency because of the potential for profit. If you’re wondering how to make money with cryptocurrency, here are some strategies to consider.

1. Buying and Holding (HODL)

The simplest way to profit from cryptocurrency is to buy and hold coins for the long term. This strategy relies on the belief that certain cryptocurrencies, like Bitcoin or Ethereum, will increase in value over time. You buy when prices are low, hold the coins in a secure wallet, and sell when the price has increased significantly.

Tips for Success:

- Research: Understand the coin you’re investing in. Study its purpose, development team, and long-term potential.

- Patience: Cryptocurrency is volatile. HODLing requires a long-term perspective and the ability to withstand market fluctuations.

2. Day Trading

For those who prefer a more active approach, day trading involves buying and selling cryptocurrencies within short timeframes to take advantage of price swings. While this method can be highly profitable, it also requires experience, analysis, and a deep understanding of market trends.

Tips for Success:

- Technical Analysis: Learn how to analyze charts and market data.

- Risk Management: Only invest what you can afford to lose, and set stop-loss limits to prevent significant losses.

3. Staking

Staking involves holding a cryptocurrency in your wallet to support the operations of a blockchain network. In return, you earn rewards in the form of more cryptocurrency. Coins like Ethereum 2.0, Cardano, and Polkadot allow users to stake their tokens for rewards.

Benefits of Staking:

- Passive Income: Staking generates a steady income without active trading.

- Network Support: By staking, you contribute to the security and efficiency of the blockchain.

4. Mining

Mining is the process of verifying and adding transactions to the blockchain in exchange for cryptocurrency rewards. Bitcoin mining, for example, involves solving complex mathematical problems to validate transactions. However, mining requires significant computing power and can be expensive due to energy costs.

Tips for Success:

- Choose the Right Cryptocurrency: Some coins are easier to mine and offer better rewards for smaller setups.

- Consider Pool Mining: Pool mining allows multiple miners to combine their computing power and share the rewards, increasing your chances of earning.

5. Participating in Initial Coin Offerings (ICOs)

An ICO is a fundraising method where new cryptocurrencies are sold to investors in exchange for established cryptocurrencies like Bitcoin or Ethereum. If the project succeeds, the value of the new coin can increase significantly, providing early investors with substantial returns. However, ICOs carry high risk, as many have turned out to be scams.

Conclusion: Weighing Safety and Profit in Cryptocurrency

So, is cryptocurrency safe? The answer is that it can be, but it depends on your approach. Understanding the risks and taking proper precautions—like securing your wallets, using reputable exchanges, and avoiding scams—can help protect your investments.

When it comes to profiting from cryptocurrency, there are various strategies, from long-term holding to active trading and staking. The key to success is research, discipline, and understanding that cryptocurrency markets are inherently volatile. With the right mindset and tools, cryptocurrency can be both safe and profitable for those willing to invest time in learning the landscape.

FAQs

1. Is cryptocurrency legal?

Yes, in many countries, cryptocurrencies are legal to buy, sell, and trade, though regulations vary widely.

2. Can I lose all my money in cryptocurrency?

Yes, due to the volatility of the market, there’s a possibility of losing your entire investment.

3. Is it too late to invest in Bitcoin?

While Bitcoin’s price has risen significantly since its inception, many believe it still has room for growth, especially as mainstream adoption increases.

4. What is a cryptocurrency wallet?

A wallet is a tool that stores your private and public keys, allowing you to send, receive, and manage your cryptocurrencies securely.

5. Can I make a living trading cryptocurrency?

Yes, some traders make substantial profits, but it requires experience, market knowledge, and the ability to manage risk effectively.

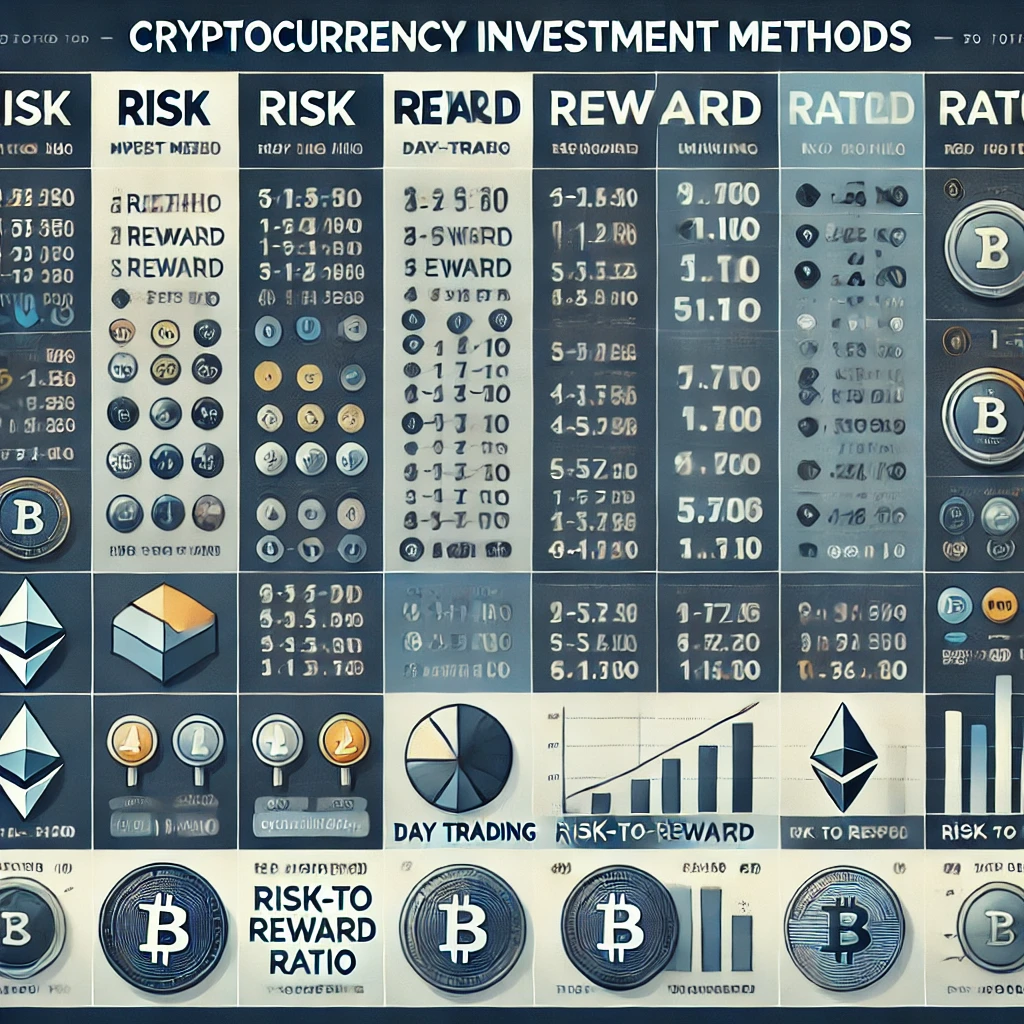

Cryptocurrency Investment Methods: Risk, Reward, and Ratios

| Investment Method | Average Risk (1-10) | Average Reward Potential (1-10) | Risk-to-Reward Ratio |

|---|---|---|---|

| HODLing (Long-term Holding) | 4 | 8 | 1:2 |

| Day Trading | 8 | 9 | 8:9 (Almost 1:1) |

| Staking | 2 | 5 | 2:5 |

| Mining | 6 | 7 | 6:7 |

| ICO Investment | 9 | 10 | 9:10 |